Calendar of Events

M Mon

T Tue

W Wed

T Thu

F Fri

S Sat

S Sun

0 events,

0 events,

0 events,

6 events,

Cook County Property tax bill due (1st installment)

In Cook County, the due date for the First Installment property taxes is always the first business day in March. According to Illinois law, the First Installment taxes are 55% of the prior year's total tax. All changes to assessment, tax rates and exemptions are reflected on Second Installment taxes due August 1st. If you

Property Tax Appeal Starting Date – Oak Park Township, Cook Couny

Property tax appeals session for Oak Park township properties opens at the Assessor's Office - to close within 30 days. To learn more about the appeal process at county and state agencies, or about opportunities for tax relief with exemptions, refunds and more — visit the Resources Page of Raila & Associates, PC for information and answers.

Property Tax Appeal Starting Date – Berwyn Township, Cook County

Property tax appeals session for Berwyn township properties opens at the Assessor's Office - to close within 30 days. To learn more about the appeal process at county and state agencies, or about opportunities for tax relief with exemptions, refunds and more — visit the Resources Page of Raila & Associates, PC for information and answers.

2 events,

Property tax appeal deadline – Riverside township, Cook County

Today is the deadline for tax appeals at the Cook County Assessor’s Office for Riverside township properties. If you miss your deadline, there may be other options for subsequent appeals and tax relief. To learn more about the appeal process at county and state agencies, or about opportunities for tax relief with exemptions, refunds and

0 events,

0 events,

0 events,

2 events,

Property tax appeal deadline – River Forest township, Cook County

Today is the deadline for tax appeals at the Cook County Assessor’s Office for River Forest township properties. If you miss your deadline, there may be other options for subsequent appeals and tax relief. To learn more about the appeal process at county and state agencies, or about opportunities for tax relief with exemptions, refunds

0 events,

0 events,

0 events,

0 events,

0 events,

2 events,

Property tax appeal deadline – Norwood Park township, Cook County

Today is the deadline for tax appeals at the Cook County Assessor’s Office for Norwood Park township properties. If you miss your deadline, there may be other options for subsequent appeals and tax relief. To learn more about the appeal process at county and state agencies, or about opportunities for tax relief with exemptions, refunds

0 events,

0 events,

2 events,

Property Tax Talk (CIC) – at Southwest Organizing Project

Property Tax Talk (CIC) – at Southwest Organizing Project

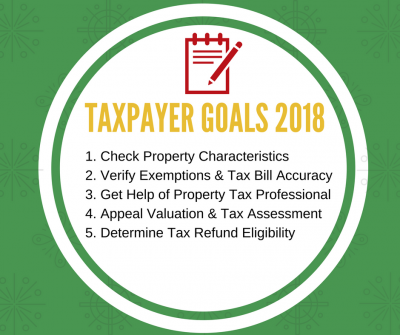

Learn how to lower your property taxes, get tax exemptions, refunds and understand market value reassessment notices. Get self-help tax links, tips and more! Property management training organized by Community Investment Corporation (CIC) and presented by Raila & Associates, P.C. If you want to see in more detail what you’ll learn at a property tax

0 events,

0 events,

0 events,

2 events,

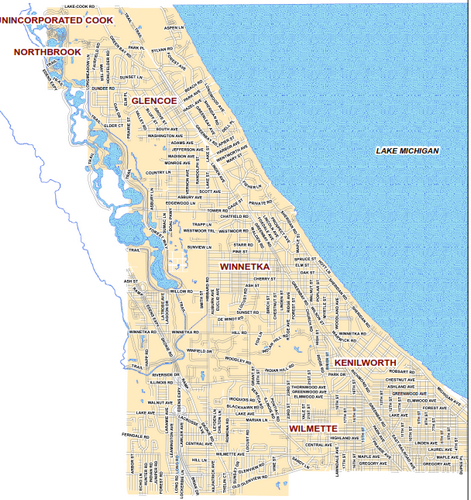

Property Tax Appeal Starting Date – New Trier Township, Cook County

Property tax appeals session for New Trier township properties opens at the Assessor's Office - to close within 30 days. To learn more about the appeal process at county and state agencies, or about opportunities for tax relief with exemptions, refunds and more — visit the Resources Page of Raila & Associates, PC for information and answers.

0 events,

0 events,

2 events,

Cook County Property Tax Appeal – Elk Grove Township opens

Property tax appeal session for Elk Grove township properties opens. The last date to file an appeal with the Assessor's Office is April 23rd, 2018.

0 events,

0 events,

0 events,

2 events,

Property Tax Appeal Deadline – Evanston Township, Cook County

Today is the deadline for tax appeals at the Cook County Assessor’s Office for Evanston Township properties for 2018 tax year, payable in 2019. If you miss your deadline, there may be other options for subsequent appeals and tax relief. To learn more about the appeal process at county and state agencies, or about opportunities