Property tax talk (CIC) – Forest Park Village Hall

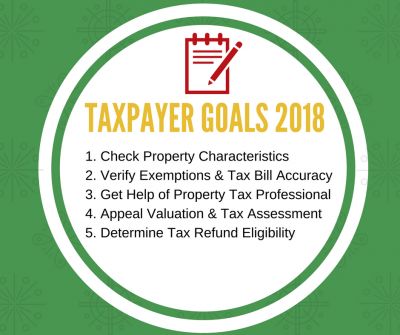

Forest Park village Hall 517 Desplaines Ave, Forest Park, IL, United StatesLearn how to lower your property taxes, get tax exemptions, refunds and understand market value reassessment notices. Get self-help tax links, tips and more! Property management training organized by Community Investment Corporation (CIC) and presented by Raila & Associates, P.C. If you want to see in more detail what you’ll learn at a property tax

Property tax appeals for Evanston properties starting date at Assessor’s Office

Property tax appeals session for Evanston township properties opens at the Assessor's Office - to close within 30 days. To learn more about the appeal process at county and state agencies, or about opportunities for tax relief with exemptions, refunds and more -- visit the Resources Page of Raila & Associates, PC for information and answers.

Property Taxes 101 (Money Smart) – Harold Washington Library

Harold Washington Library 400 S State St, Chicago, ILLINOIS, United StatesProperty Taxes 101 (Money Smart) – Harold Washington Library

Harold Washington Library 400 S State St, Chicago, ILLINOIS, United StatesLearn how to lower your property taxes, get tax exemptions, refunds and understand market value reassessment notices. Get self-help tax links, tips and more! Presented by Raila & Associates, P.C. If you want to see in more detail what you'll learn at a property tax information session CLICK HERE, or to learn more about Cook

Property tax talk (CIC) – at Chicago Theological Seminary

Chicago Theological Seminary 1407 E 60th St Room 118, Chicago, United StatesProperty tax talk (CIC) – at Chicago Theological Seminary

Chicago Theological Seminary 1407 E 60th St Room 118, Chicago, United StatesLearn how to lower your property taxes, get tax exemptions, refunds and understand market value reassessment notices. Get self-help tax links, tips and more! Property management training organized by Community Investment Corporation (CIC) and presented by Raila & Associates, P.C. If you want to see in more detail what you'll learn at a property tax

Cook County Property tax bill due (1st installment)

In Cook County, the due date for the First Installment property taxes is always the first business day in March. According to Illinois law, the First Installment taxes are 55% of the prior year's total tax. All changes to assessment, tax rates and exemptions are reflected on Second Installment taxes due August 1st. If you