Bookmark the Raila PC Self Help Resources Page for links to helpful

tax and appeal documents, forms, websites and information.

External Resources

- Cook County Exemptions (8)

- CC Treasurer: Property Tax Overview for tax bill, exemption and overpayment information on your home

- IL General Homeowners/Leasehold Exemption Statutes

- How Tax Bills Are Calculated (Cook County Clerk)

- Illustration: How Taxes Are Distributed (Chicago & North/South Suburbs-CC Clerk)

- Disaster and Flood Damage Guidelines (Cook County)

- Discover Your Unclaimed Assets !

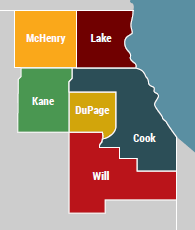

Northern Illinois Appeal Deadlines

Click on the link for your county’s Appeal Deadlines:

Cook County Deadlines,

Townships & Valuation Stats

Lake

DuPage

Kane

McHenry

Will

ATTENTION PROPERTY OWNERS: Get the right exemption for the tax relief you deserve

You can only receive the Homeowner exemption on your primary residence. Cook County owners – click here to see what additional exemptions you may be eligible for and click here to see what exemptions you have recently received.

You may be eligible for refunds for exemptions missing for up to three years. You can apply for these refunds on your own or with the help of a professional.

A new law regarding multiple homeowner exemptions was recently passed. Find more information click here.

If you are receiving exemptions on multiple properties and would like to remove these erroneous exemptions, you can find the waiver form click here.