Raila & Associates, PC assists property owners in Chicago, Cook County and Illinois seeking residential property tax relief. We help owners reduce their assessed value for savings on current or future tax bills, and in some cases to obtain refunds.

You pay only if we help you win tax relief.

Residential Property Tax Appeals

Raila PC has experienced legal counsel and staff to assist owners, managers and tenants in achieving tax relief. The firm also can refer clients to appraisers and other professionals who can support our efforts to achieve tax relief.

If you are a homeowner or owner of a 1-6 unit building, you can CLICK HERE to request a Property Tax Assessment Evaluation to determine the fairness of your assessment and your chances for residential property tax relief. Or call us at 312-587-9494, prompt 4, to speak with one of our Residential Case Analysts.

The Tax Appeal Process

Our team can guide you through the tax appeal process, which can include an appeal of your property assessment based on Lack of Uniformity, Overvaluation, Property Description Errors and/or changes to your property’s condition. These appeals can be made with County Assessors, Boards of Review and at the Property Tax Appeal Board in Illinois. READ MORE about what our services can include.

Exemptions Can Save You Money

Are you aware that many counties have at least five exemptions and Cook County has eight? If you live in your home or recently improved it; are a senior citizen or long-time resident; are a veteran or disabled person — one of our case analysts can help you make sure your exemptions are accurate. If exemptions are not accurate, you may be eligible for appeals or refunds as far as three years back – sometimes totaling hundreds of dollars.

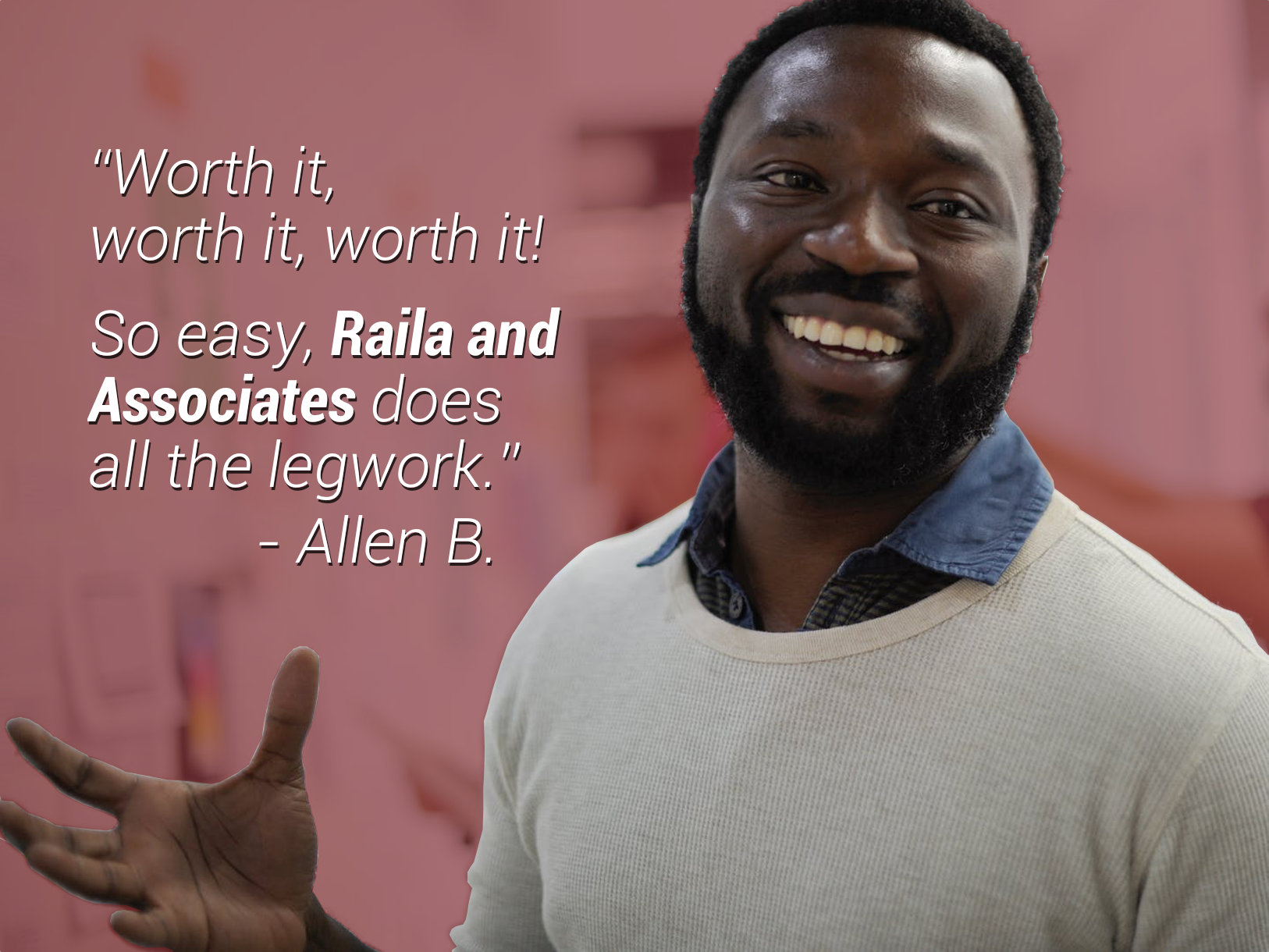

Competitive Rates, Quality Customer Service & Persistence

You pay only if Raila & Associates, PC helps you win tax relief. With each favorable agency decision, clients are typically billed a percentage of the first year’s estimated tax savings (savings can last up to three years). The firm educates consumers and clients about their rights and responsibilities in the assessment and appeal process; informs clients of their case status and decisions; and helps them understand their tax bills and invoices. Most importantly, the firm persistently pursues subsequent agency appeals until fair tax levels are achieved.

Learn More About These Appeals & Processes

Commercial Property Tax Appeals

Business, Industrial, and Multi-unit Residential

Condos & Townhomes

Owners & Associations of Large and Small Properties