Raila & Associates, P.C. assists and represents taxpayers of all kinds with real estate tax appeals for residential property (single family and 1-6 unit buildings), commercial property (7+ unit rental properties, businesses, industrial and retail property, farms and vacant land), and those related to condominiums, townhomes and cooperatives.

You pay only if we help you win tax relief.

We are persistent and will pursue appeals at different agencies until you achieve fair taxes.

Download Our Sample Tax Bill

which provides an explanation of every

component of your tax bill.

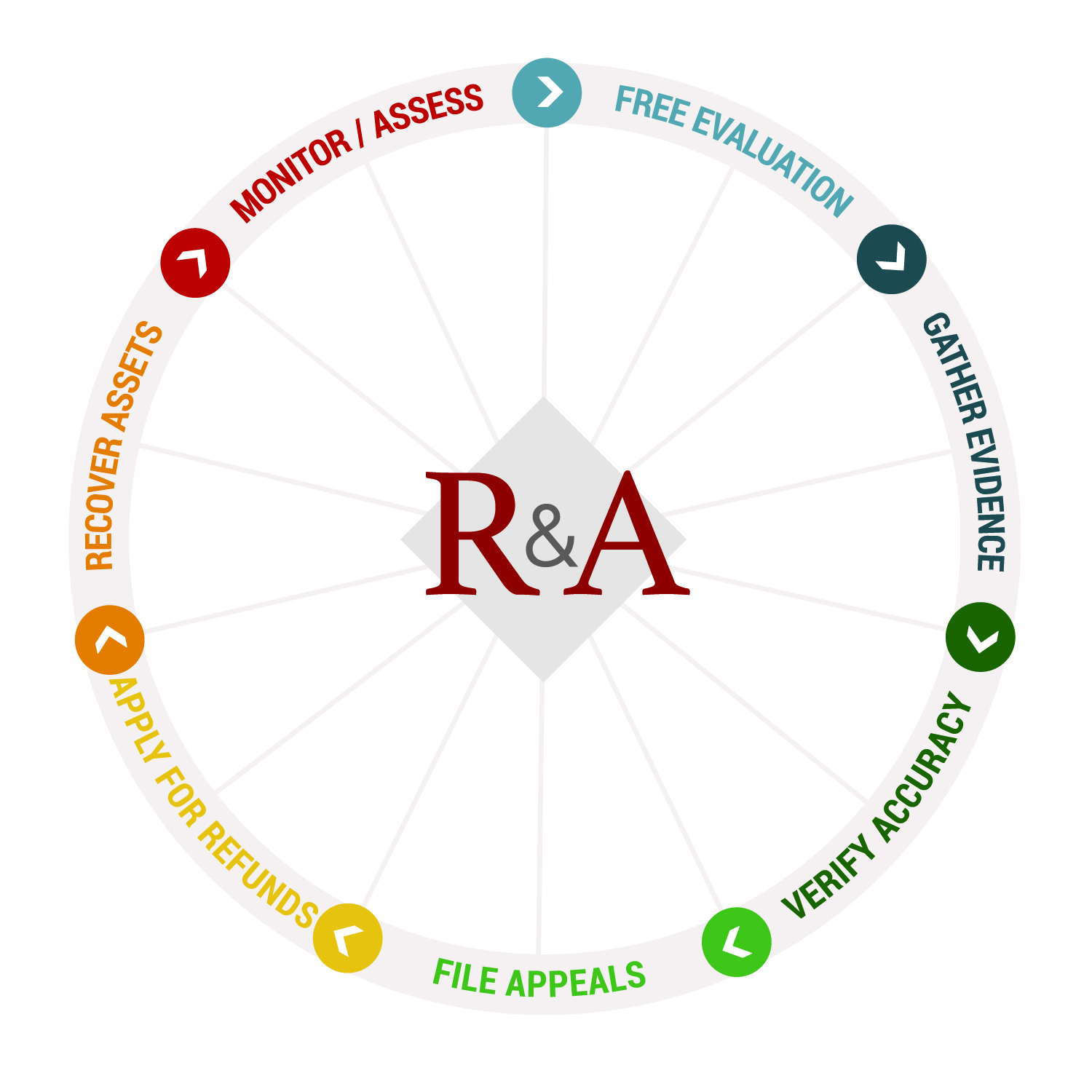

Our Services Include

- Conducting Free Evaluations

of your property tax assessment - Gathering documentation and evidence

to help support successful appeals - Verifying accuracy of public records

descriptions, classifications, exemptions - Filing appeals for Tax Relief

representing you at county and statewide agencies

- Applying for refunds from prior years

correcting assessment, exemption, and other errors - Discovering & recovering assets

including duplicate and inadvertent payments - Monitoring property tax / Assessment

watching for long-term tax relief opportunities

Raila & Associates, PC provides free property assessment evaluations for prospective clients so that they may know if they have a chance for tax relief. Our team determines if a property appears to be fairly assessed or if our representation can assist in an appeal for an assessment reduction. All property owners, even if they are not clients, are invited to attend a free Property Tax Information Session. These tax talks inform participants about the assessment and appeals system so they are better prepared to hold a property tax consultant or professional accountable, or appeal on a DIY basis.

Our team gathers evidence that supports the case for an assessment reduction, investigating comparable residential properties and by delving into issues of condition, valuation, income, occupancy and relevant market forces for both residential and commercial cases.

Although challenging assessments by filing appeals at county and statewide agencies is the primary service of the firm, Raila PC also can help clients examine their property descriptions, classifications and exemptions to determine if there are other opportunities to correct a property’s official record and save on taxes. We can further assist taxpayers with the discovery or recovery of assets; for example, when property owners mistakenly overpay tax bills or duplicate the payments of escrow agents.

In certain qualifying instances — when errors in assessment, exemptions, or characteristics are present — clients may be eligible for refunds for up to three prior years, and when engaged to help, Raila & Associates, PC will represent the case and see it through the entire process.

Clients engage our firm for one tax year at a time, but most of our new clients renew our services as long as they have an opportunity for tax relief. Once our services have been engaged, Raila PC monitors assessments going forward, re-contacting clients with changing circumstances and assessments, and the cycle of services begins again.

Learn More About These Appeals & Processes

Commercial Tax Appeals

Business, Industrial, and Multi-unit Residential

Residential Tax Appeals

Homeowners & Small Buildings (1-6 units)

Condo & Townhome Appeal Services

Owners & Associations of Large and Small Properties