WHOSE TAXES ARE TOO HIGH?

2nd Installment Tax Bills are Out in Chicago and Suburbs of Cook County !

Cook County homeowners, business, and commercial property owners are receiving their second installment tax bills in the mail just about now. For those of you in need of a refresher and answers to frequently asked questions (FAQs) about tax bills, we at Raila PC offer this information.

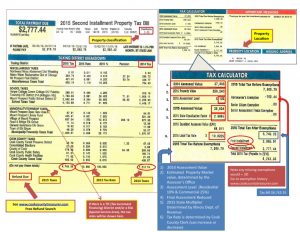

Although the First Installment tax bill was 55% of the the prior year’s total taxes paid, your Second Installment does not total 45%! This bill includes tax rate adjustments that vary by township and taxing body – the government entities seeking to balance their budget – including everything from school and water districts, to park districts and hospital systems.

Changes also result from calculations made based on the new State Equalization Factor, otherwise known as the “multiplier”. This multiplier corrects for undervaluation of property in the opinion of the state. In most other counties in the state, the local assessed valuation is accepted as accurate. In contrast, the multiplier (2.8032 this year) in Cook County almost triples the valuation, as reflected on your second installment tax bill. CLICK HERE TO SEE A SAMPLE ANNOTATED TAX BILL.

Changes also result from calculations made based on the new State Equalization Factor, otherwise known as the “multiplier”. This multiplier corrects for undervaluation of property in the opinion of the state. In most other counties in the state, the local assessed valuation is accepted as accurate. In contrast, the multiplier (2.8032 this year) in Cook County almost triples the valuation, as reflected on your second installment tax bill. CLICK HERE TO SEE A SAMPLE ANNOTATED TAX BILL.

In some circumstances the assessment or amount due can be adjusted in your favor by a couple of other factors. First, if you have successfully appealed your taxes, the corrected assessment and savings will be reflected on this Second Installment (due August 1) tax bill. Second, if you qualify for and have applied for one or more Homestead Exemptions, the savings lowers your tax bill again. Always verify if your exemptions are correct to assure that you avoid penalties and get the savings you deserve. LEARN MORE ABOUT EXEMPTIONS.

If errors in property description, classification, exemptions, or assessment appear on a Second Installment tax bill, taxpayers may be eligible for refunds. Click RailaPC or call us at (312) 587-9494 to learn more. For info on due dates for property tax bill payments and delinquent tax sales, check out the COOK COUNTY TREASURER SCHEDULE.

Even if there are no errors on your tax bill, it may be time to research your property tax assessment for a possible appeal – so your next year’s tax bill could be lower. CLICK HERE FOR A FREE EVALUATION.