Palos township, Cook County, opens for appeals – to close within 30 days

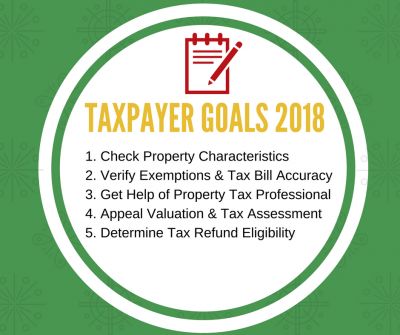

Property tax appeal window opens for Palos township taxpayers at the Cook County Assessor's Office - to close within 30 days. If you want to learn more about reassessments, appeals and exemptions in Cook County, visit the Resources Page of Raila & Associates, PC for information and answers.

Property tax talk (CIC) at JLM Life Center (Lower Level)

JLM Life Center 2622 W Jackson Blvd, Chicago, IL, United StatesProperty tax talk (CIC) at JLM Life Center (Lower Level)

JLM Life Center 2622 W Jackson Blvd, Chicago, IL, United StatesAs part of the property management training offered by Community Investment Corporation (CIC) and presented by Raila & Associates, PC -- you can learn how to lower your property taxes, get tax exemptions, refunds and understand market value reassessment notices. Get self-help tax links, tips and more!  Call Jessica Sivels at CIC (312) 870-9914 for

Property tax appeals for Cicero Township (Cook County) start today

Property tax appeals for Cicero township property owners/taxpayers start today. The deadline to file an appeal with the Assessor's Office is May 17th, 2018.

Property tax appeals for Cicero township, Cook County, start today

Property tax appeal window for Cicero township property owners/taxpayers opens today with a final date to file an appeal at the Cook County Assessor's Office of May 17th, 2018.

Property Tax Talk ( CIC) at Chicago Theological Seminary

Chicago Theological Seminary 1407 E 60th St Room 118, Chicago, United StatesProperty Tax Talk ( CIC) at Chicago Theological Seminary

Chicago Theological Seminary 1407 E 60th St Room 118, Chicago, United StatesLearn how to lower your property taxes, get tax exemptions, refunds and understand market value reassessment notices. Get self-help tax links, tips and more! Property management training organized by Community Investment Corporation (CIC) and presented by Raila & Associates, P.C.  Call Jessica Sivels at CIC (312) 870-9914 for more information or to Register CLICK HERE ! If